Special Assessments are the typical unwanted consequence when an Association is surprised by significant expenses that are larger, or earlier, than expected. But in our experience, most special assessments are avoidable.

This is because most special assessments are caused by painting, roofing, or roadway projects that gradually deteriorated over time. It was not surprising that the roof failed, and it was not surprising when the roof failed. It was only surprising how little Reserves the association set aside towards that inevitable, predictable expense.

Special assessments are unsettling for the association, both financially and politically. It is embarrassing for an association to find itself facing a special assessment for a project that gradually deteriorated over time.

Minor surprises should always be expected, such as a roof failing a year earlier than planned, or needing to do some wood repairs prior to the expected repainting project. An association with a strong Reserve Fund is better prepared to absorb such minor surprises without being forced into a Special Assessment. In such cases, an adjustment is made to the Reserve contribution rate the year after expenses were higher than expected, and the Association goes back to operating smoothly.

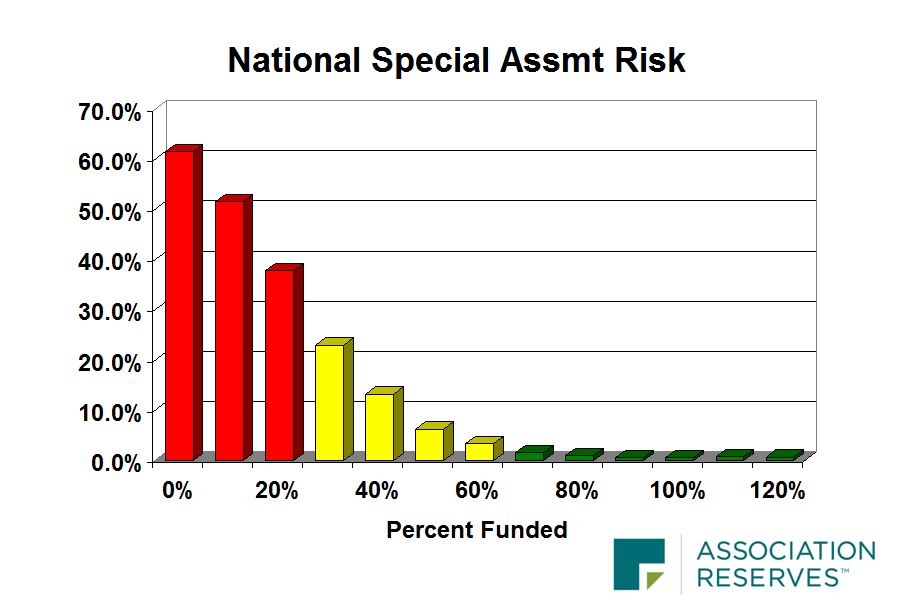

But how do you know your Association’s special assessment risk? Do you need to be 100% Funded to have a reasonable expectation to be free from special assessments? In a word, no. Please see the graph below.

To no one’s surprise, when an Association is 100% Funded or more (i.e., Reserves on-hand are equal to or above the deteriorated value of their Reserve components), there is almost no chance of a special assessment.

But as you move to the left and the Percent Funded drops (i.e., Reserves on-hand become a smaller and smaller fraction of Reserve component deterioration), the risk of special assessments increases. For instance, the graph shows that if an association is 0% – 10% “Funded”, there is slightly higher than a 50% chance that the association will have inadequate cash to perform its anticipated Reserve projects during the year, and the Board will need to propose a special assessment.

This graphic also shows clearly why we consider a Reserve Fund in the 0-30% range “weak”, a Reserve Fund in the 30-70% range “fair” and anything over 70% as “strong”.

Associations that have a relatively little cash on-hand in their Reserve Fund often find their Reserves inadequate, even if they planned their Reserve cash flow down to the penny. That’s because things don’t happen exactly as you predict. Designing for a relatively strong Reserve Fund provides a margin for protection when Reserve expenses are higher than expected or earlier than expected.

Percent Funded is a reliable predictor of Special Assessment risk and special assessments are something to avoid. This is why you should care about Percent Funded and why various parties outside the Association (i.e., lenders, prospective homeowners, FHA, etc.) should and do care.