As an HOA board member, one of your primary responsibilities is ensuring the financial health of your community. This includes managing your reserve fund strength, a crucial component of your association’s long-term stability, safety, and value.

But how do you know if your reserve fund is enough? Are you adequately prepared for expected expenses like roof replacements, exterior painting, or major repairs? Today we’ll teach your HOA board about the tools used to assess your HOA reserve fund strength. This will help you better understand your community’s financial health so you can make informed decisions.

How to Measure Your HOA Reserve Fund Strength

The first step in evaluating your HOA’s financial health is to understand the current strength of your reserve fund. This assessment is not merely about the cash in your bank account but about how well this cash meets the association’s needs.

- Reserve Component List: Begin with a comprehensive reserve component list that outlines all expected projects. This list should follow National Reserve Study Standards, detailing each project’s useful life (UL), remaining useful life (RUL), and current cost.

- Fully Funded Balance: Then calculate the Fully Funded Balance, which is the sum of the fractional age of each component multiplied by its current cost (Fractional Age X Current Cost for each component, summed together for all components = Fully Funded Balance). This balance represents the ideal amount you should have in reserves at this time to offset current deterioration.

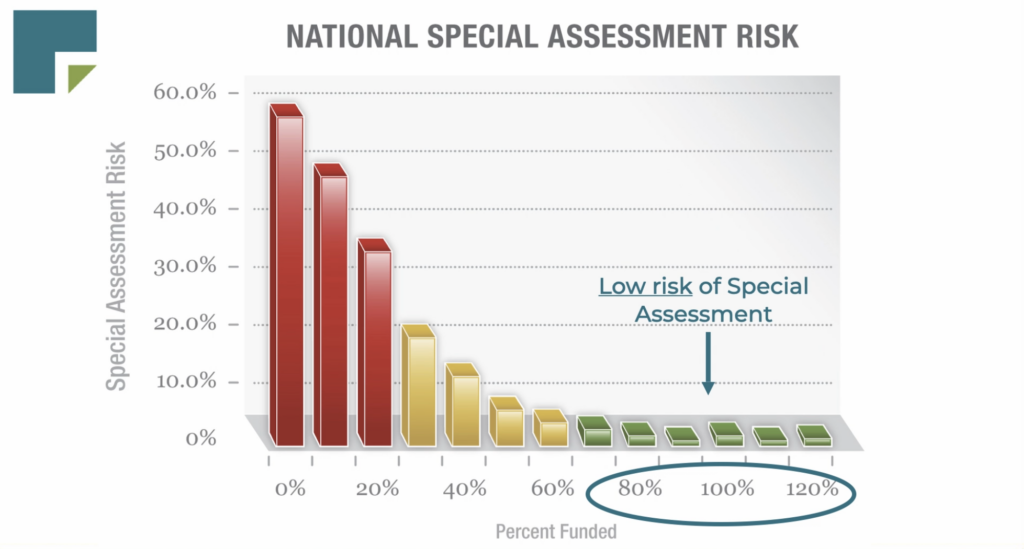

- Percent Funded: Do you have enough in your HOA reserve fund? Compare your current reserve balance to the current Fully Funded Balance to determine your Percent Funded. This metric provides a clear indicator of your reserve fund’s strength:

- 0-30% Funded: Weak – High risk of HOA special assessments

- 30-70% Funded: Fair – Moderate risk of HOA special assessments

- 70-100% Funded: Strong – Low risk of HOA special assessments

Next Steps: HOA Budgeting and Funding Reserves

Once you understand your reserve fund’s current strength, the next step is to plan your future funding. Find out if your HOA needs to catch up and strengthen its reserves, or stabilize it at a strong position.

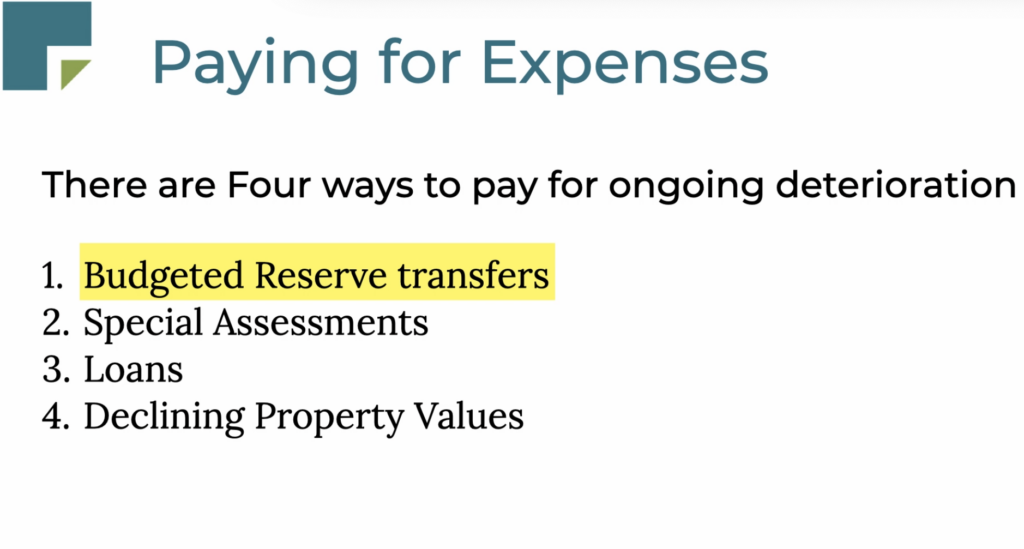

Deterioration and Funding Needs: Recognize that deterioration is continuous and predictable. Your HOA reserve fund should grow over time to cover these predictable expenses. The goal is to avoid deferred maintenance, special assessments and expensive loans by adequately funding reserves through budgeted transfers.

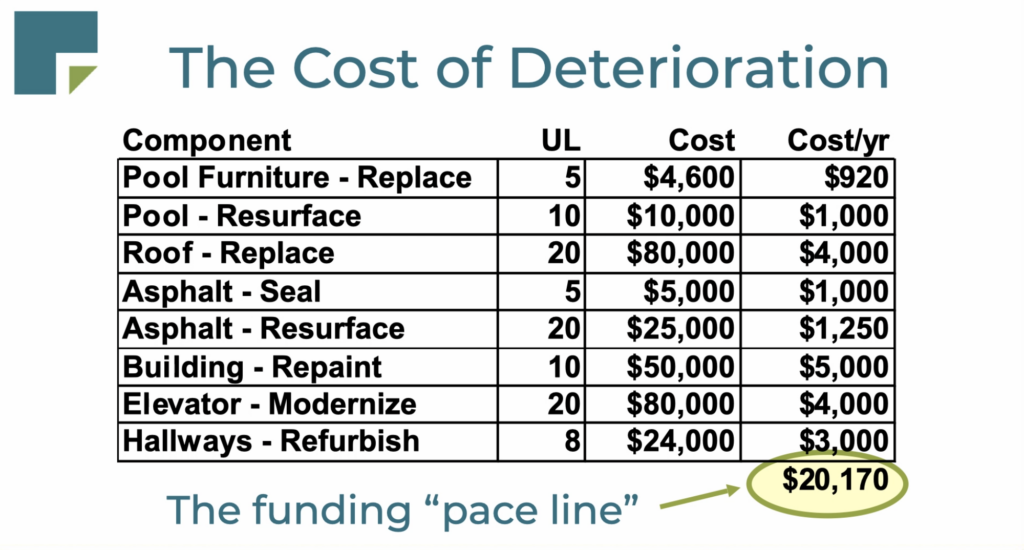

Annual Deterioration Rate: Calculate the annual cost of deterioration for each component (current cost divided by useful life). Your annual reserve funding will need to be in the same range as this rate of ongoing deterioration. See this in the example below.

Long-Term Financial Plan: Develop a multi-year funding plan to strengthen your reserves if they are currently weak (budget for Reserve transfers higher than your current “deterioration rate”). This may involve increasing reserve funding or implementing catch-up special assessments, depending on your cash flow requirements. Conversely, if your reserves are strong, maintain a steady funding rate to avoid overburdening current homeowners.

Uniting Homeowners with the HOA Board

Effective communication with homeowners is essential for gaining support for reserve funding initiatives.

- Transparency: Clearly explain the purpose of reserve funding. It is not a voluntary “contribution” to “help out” future owners, but a necessary bill to offset the deterioration that is happening right now.

- Fairness: Highlight that reserve funding ensures all homeowners pay their fair share of the association’s costs during their ownership, preventing future homeowners from facing unexpected special assessments (due to the cost of deterioration that occurred prior to owning a home in the association).

By understanding the principles of reserve fund strength and implementing a strategic funding plan, you can make sure your HOA is financially prepared for the future. Don’t let your association fall behind! Remember, a strong reserve fund is not just a financial metric; it’s a testament to your community’s long-term sustainability and the well-being of its residents.

Need more support? Talk to Association Reserves to get one of our reserve study specialists on your team here.