1. WHICH COMPONENTS ARE REQUIRED TO BE FUNDED THROUGH RESERVES IN FL?

Condominiums are required to fund for Roof Replacement, Building Painting, Pavement Resurfacing, and any other item for which the deferred maintenance expense or replacement cost exceeds $10,000. FL statutes governing Co-Ops generally mirror Condominium regulations. HOAs (associations where individuals maintain their own homes and the association only maintain the common area infrastructure) in FL are regulated by a different body of law, which does not have a specific minimum list of components they are required to fund through Reserves.

2. ARE THERE SIMILAR REGULATIONS IN OTHER STATES?

WA passed similar legislation effective 1/1/2012, requiring Reserve funding in condominiums of Roof Replacement, Building Painting, Pavement Resurfacing, Decks, Siding, Plumbing, Windows, and any other reserve component that would cost more than 1% of the annual budget for major maintenance, repair or replacement.

3. WILL ADDRESSING THESE REQUIRED COMPONENTS MEET AN ASSOCIATION’S RESERVE OBLIGATIONS?

Not likely. These are just minimum lists.

4. HOW DOES NATIONAL RESERVE STUDY STANDARDS (NRSS) COME INTO PLAY?

National Reserve Study Standards, effective since 1998, establish a four-part test (not a checklist) to determine which components should be funded through Reserves. The four part test is that the asset must be a common area maintenance responsibility, life limited, with a predictable remaining useful life, and above a minimum threshold cost (typically .5% – 1% of the annual budget). Following this NRSS test allows the association to successfully create a Reserve Component list customized to the major, predictable projects in an association’s future (in addition to those minimum components required by statute). Note that an effective Reserve Component List tends to be relatively stable from year to year, minimizing the chance some assets will be missed or appear in both the Operating and Reserve budget.

5. WHAT IS THE BIGGEST MISTAKE AN ASSOCIATION CAN MAKE WITH THEIR RESERVE COMPONENT LIST?

Presuming that funding for the minimal components required by statute will be sufficient. Boards, managers, and homeowners must continue to be diligent to ensure that the major assets at their association are being funded on an ongoing basis through Reserves.

6. CAN/SHOULD AN ASSOCIATION RESERVE FOR INSURANCE DEDUCTIBLES?

Because insurance deductible charges cannot be predicted, they fail the NRSS four-part test. But where insurance deductibles are significant in size and a pattern of loss can be reasonably established, it is prudent for an association to set a reasonable “allowance” amount for a possible deductible expense on a defensible Useful Life interval (5 to 10 years or so) so that in the event of a loss, there are some Reserves to work with, to use to supplement a special assessment.

7. WHAT IF THE ASSOCIATION PAINTS THE BUILDING EXTERIORS ON AN ONGOING BASIS THROUGH THE OPERATING BUDGET (NOT RESERVES)?

If all building painting is being handled through the Operating Budget, there is nothing to fund through Reserves. Some associations do a hybrid, painting some assets from the Operating budget and some from Reserves. Some pay painter payroll through the Operating budget and materials through Reserves. Ensure that all aspects of the painting needs of the association are budgeted, whether in Operating or Reserves, and fully disclosed to the membership.

8. HOW CAN YOU RESERVE FOR PROJECTS LIKE ASPHALT SEAL COATING OR BUILDING PAINTING THAT THE IRS DOES NOT CONSIDER CAPITAL PROJECTS?

Prepare your taxes according to IRS standards, but budget for the needs of the association according to State Law, NRSS, and the practical needs of the association. The two do not need to share the same underlying principles.

9. IS THERE A USEFUL LIFE, BEYOND WHICH IS “TOO FAR AWAY” TO FUND THROUGH RESERVES?

According to NRSS, no. Many major projects have very extended, predictable Useful Lives (in excess of 20 or 30 years). If the project is reasonably predictable, it is only fair that those using/enjoying the asset pay their small, fractional share of its deterioration spread over all the years that it serves the association.

10. WHAT SHOULD WE DO ABOUT TRUE SURPRISES (PROJECTS NOT ANTICIPATED IN RESERVES)?

The board’s primary responsibility is to care for the assets of the association. So perform the repair/replacement first, and figure out the accounting second. If in hindsight the project should have appeared in the Reserve Study (it is a major project, the maintenance responsibility of the association, and it will likely happen again on a similar schedule), then pay for the project through Reserves and add the project to the Reserve Component List in the next year’s Reserve Study update. If it is not a Reserve-type project, then the replacement will likely need to be funded through either (or both) insurance proceeds or special assessment.

11. WHAT DO YOU DO, IN THE CASE OF A “SURPRISE” AND THERE ARE NOT ENOUGH FUNDS IN RESERVES TO HANDLE THE EXPENSE?

There are the obvious problems like the procedural issues about passing and collecting a special assessment, or the paperwork and additional expenses that come from borrowing. So it is always a good idea to maintain a strong Reserve fund. While running out of money is a demonstration that the Board didn’t provide for the needs of the association, it rarely triggers litigation because it is still each owner’s responsibility to pay their fair share of ongoing deterioration. Suing the association, or Boardmembers individually, doesn’t solve the problem of a leaky roof.

12. CAN RESERVE FUND STRENGTH BE MEASURED, IN ORDER TO GIVE AN INDICATION OF OUR RISK OF A SPECIAL ASSESSMENT?

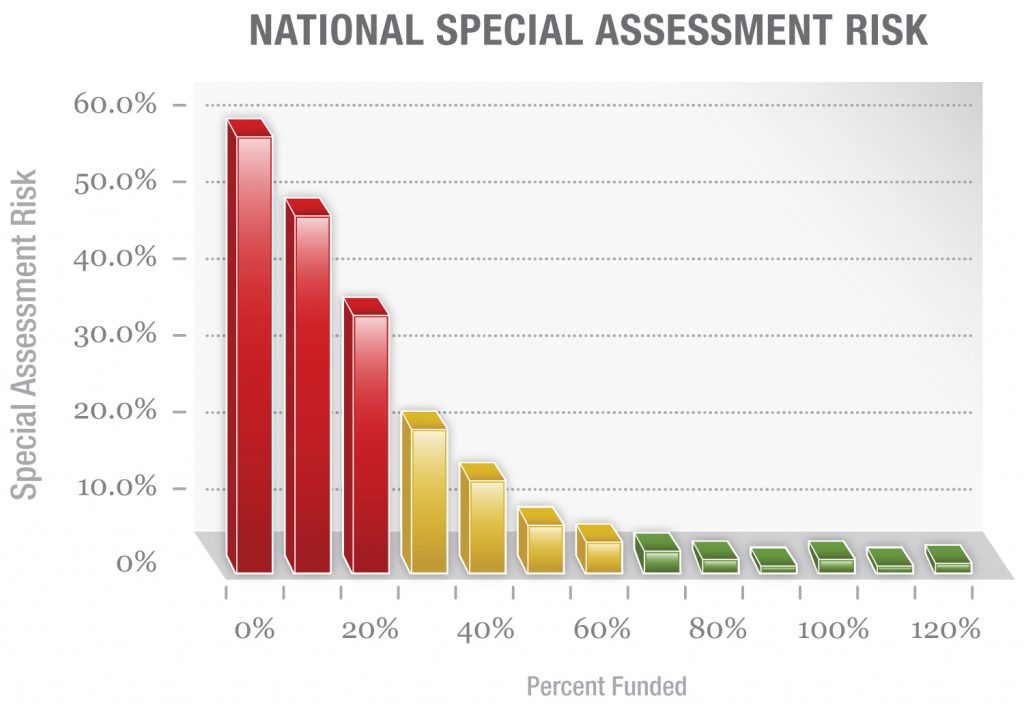

Yes, assuming the Reserve Component List has been prepared according to NRSS and there are no significant components “missing”. Reserve Fund strength is measured through a NRSS term called Percent Funded, which is the comparison of the association’s actual Reserve cash balance to the Reserve deterioration at the association. When the Reserve Fund cash equals the value of Reserve deterioration around the association, there is balance, and the association is 100% Funded. When Reserve cash is less than deterioration (the case for most associations), the association is in a deficit situation (Percent Funded less than 100%). The more extreme the deficit, the more likely the association will face a special assessment due to a Reserve cash-flow crisis. See this relationship in the chart below:

13. WHO IS RESPONSIBLE FOR THE ACCURACY OF THE RESERVE COMPONENT LIST?

Boardmembers gain some liability protection when they hire an independent credentialed professional to prepare the Reserve Study update. Boardmembers need to remain diligent, checking to make sure there are no obvious errors like the # of elevators, the street being maintained by the city, or the year the roof was last replaced. Once a professional has laid the foundation of an appropriate Reserve Component List, future updates are a much simpler process. Many associations keep their Reserve Study costs down by having a Reserve Study professional update the Reserve Study every few years, doing updates themselves in the in- between years. The liability exposure for doing an in-house minor annual update is low.

14. DOES THE BOARD TAKE ON LIABILITY BY ANSWERING QUESTIONS POSED BY THE RESERVE STUDY PROFESSIONAL?

No. If the Reserve Study professional is the one asking the questions, and is still “driving the process”, then the primary liability remains on the professional’s shoulders.

15. WHAT SHOULD THE BOARD, MANAGER, OR HOMEOWNER DO IF THEY SUSPECT THE RESERVE COMPONENT LIST IS MISSING SOME SIGNIFICANT COMPONENTS, OR HAS TOO MANY COMPONENTS (SOME THAT ARE NOT THE ASSOCIATION’S RESPONSIBILITY TO MAINTAIN)?

All interested parties should compare the Reserve Component List to State Law, NRSS, the practical needs of the association, and their Operating Budget. The owners are relying on the Board and management to do a good job, taking care of the association and preventing disruptive special assessments. If the Board or management doesn’t feel capable or comfortable doing Reserve planning, a Reserve Study professional should be hired.

16. ARE THERE CREDENTIALS IN THE RESERVE STUDY FIELD TO HELP IN THE SELECTION OF A QUALIFIED PROFESSIONAL?

Yes. The Reserve Specialist (RS) is a credential administered by the Community Associations Institute (CAI), the national trade organization for community associations. The Professional Reserve Analyst (PRA) is a credential administered by the Association of Professional Reserve Analysts (APRA). The RS and PRA credentials are almost identical, so look for either of those credentials in a Reserve Study professional.

17. WHERE CAN I GO FOR MORE INFORMATION ON THIS SUBJECT?

For Florida seminars and training, go to www.KGBLawFirm.com and select “Classes and Events”. Another resource for those in Florida is the Community Advocacy Network. Go to www.CANFL.com, and click the link on the left to subscribe to their email newsletter. For Reserve Study answers, go to www.ReserveStudy.com, and select “Learning Center”. There you will find National Reserve Study Standards, national legislation, a library of resources, and recordings of prior webinars. You can also sign up there for the Association Reserves email newsletter to be notified of future webinars and stay informed of national Reserve Study issues.

ADDITIONAL INFORMATION NOT PART OF WEBINAR CURRICULUM, BUT PART OF Q&A SESSION AT THE END:

Q: What percentage of the membership is needed to waive reserves (condos in FL)?

A: Majority of the voting interests in a Florida association (condominium, cooperatives, and homeowners’ associations alike) is required to approve either a reduction in, or a full waiver of reserves on an annual basis.

Q: What is the process to waive reserves (condos in FL)?

A: A Majority of the voting interests must vote, in person or by proxy, at a duly called and properly noticed membership meeting of the association where a quorum is present. The association must give the membership no less than 14 days notice of such meeting unless a longer time period for such notice is required by the association’s governing documents. The membership vote to reduce or fully waive the reserve funding requirement only pertains to the fiscal year budget voted upon by the membership. As such, the membership vote to reduce or fully waive reserves must be conducted each fiscal year.

Q: What does it mean to “pool” reserve funds?

A: Once all the components have been identified, “pooling” is one of two categories of funding methods. In pooling, there is no such thing as Roof dollars or Paint dollars. Reserve expenses for each year are added, or “pooled” together. Reserve income is designed to offset those Reserve expense totals for each year, not on the basis of separate contributions to separate component needs.

Q: Which is better… pooling or straight line?

A: Remember that these are just different ways to fund Reserves, they rely on the same Component List information. I recommend the pooled, or called the “cash flow” method in NRSS terminology, because it offers more flexibility. It also eliminates the silly situation where an association has enough Reserves to accomplish a project, but has to pass a special assessment because those funds were allocated to Roofing or Painting and so were not available to be spent on an asphalt project that failed early.

Q: Does the IRS require commercial condominiums to fund Reserves using the Straight Line method?

A: No. The IRS does not weigh in on this issue.

Q: What is a Reserve Study and is it really needed?

A: A Reserve Study is a budget planning tool, designed to look forward and help an association set aside funds, on an ongoing basis, for the timely repair or replacement of the major common area assets the association is responsible to maintain. Reserve Study updates are needed on a regular basis due to always-changing circumstances, to provide budget guidance to the board of directors and management, and to provide important annual disclosures about the status of the association’s Reserve projects and the strength of the association’s Reserve Fund.

Q: Is an association required to keep Reserve Funding going as established by the Developer?

A: No. The association can and should revisit the rate of Reserve contributions established by the Developer to see if they are appropriate for the ongoing needs of the association.

Q: Should an association Reserve for “Exclusive Use” components?

A: Exclusive Use components may also be called “Limited Common Elements”. The ownership is not the issue, the issue is who is responsible for the component’s maintenance. Maintenance responsibility for such areas is typically addressed in the association’s Governing Documents. If it is the maintenance responsibility of the association, it is a candidate for Reserve designation. If it is maintained by the homeowner, it should not be considered for Reserve designation.

Q: Is it significant if painting is interior or exterior?

A: The issue is association maintenance responsibility or individual owner maintenance responsibility, not interior or exterior. Interior painting projects can appear in a Reserve Study if they are significant and are the maintenance responsibility of the association (hallways, recreation room interior, etc.). Conversely, interior painting projects inside a unit (where the owner is responsible for maintenance) should never appear in a Reserve Study.

Q: In FL condominiums, are Reserve components over $10,000 to be named?

A: Yes. Please note that for many of those FL condominium associations, Reserve projects under

$10,000 may be significant and a good idea to identify separately in the Reserve Study.

Q: What level of Reserve Fund strength (Percent Funded) would indicate “good management”?

A: Reserve Fund strength is not a direct result of good management. It is a direct result of making appropriately sized Reserve contributions over a substantial period of time. While special assessments are often found among associations in the 0-30% Funded range, associations with a Reserve Fund in the 70-130% range are typically described as having “strong” Reserves (due to lack of special assessments and deferred maintenance).

Q: Is there a specific fraction of the Operating Budget that was a recommended amount to retain in Reserves (surplus or retained earnings).

A: The answer is no. Every association’s Reserve needs are different, and those needs vary for instance if the year is right in advance of some significant needs (a re-roofing project and a re- painting project) or right after such projects. In addition, there is no direct relationship between operating budget and the physical assets of the association needing Reserve funds. The amount of Reserves appropriate to have on-deposit is a calculation based on the Reserve Component List, not the Operating Budget.

Q: I thought there was a requirement that 10% of your budget should go to Reserves?

A: Every association’s Reserve needs are different, and those needs vary with the construction type and amenities at the association. There is no direct relationship between operating budget and the physical assets of the association needing Reserve funds. The amount of Reserves appropriate to contribute, is calculated based on the Reserve Component List and the financial needs of the association, not the Operating Budget.

That said, a minimum indication of financial health the government uses in evaluating if units at an association are eligible for FHA financing is that at least 10% of the operating budget is going towards Reserves. That 10% amount has no real basis in reality, but it is a minimum indicator that at least some Reserves are being funded.

Q: Is a slurry seal ongoing maintenance? We do it about every five years.

A: A slurry seal fits the National Reserve Study Standard definition of a project the association is responsible to maintain, with a well-defined Useful Life, a predictable Remaining Useful Life, and above a threshold cost of significance. That makes it suitable for Reserve designation.

Q: We found that our Reserve Study under-estimated our asphalt square footage for years. In a recent correction, our Reserve contributions went up and our Reserve Fund strength went down. Is there any recourse against our Reserve Study professional for this error?

A: It depends on the circumstances. Such an error is certainly unfortunate. But fundamentally the Homeowners have the responsibility to pay for the needs of the association. Ideally a Reserve Study professional is able to point them in the right direction. If an estimate or projection in hindsight turns out to be inaccurate, that does not transfer the homeowner’s responsibility to pay for the project over to the Reserve Study professional.

Q: Who determines the Component List? Can a boardmember choose to eliminate an asset (tennis court, irrigation, etc.) from the list?

A: If the Reserve Study professional prepared the Component List, they take responsibility for the accuracy of the list (it is, after all, their name on the cover of the report). We trust clients will review the Component List for accuracy. If the tennis court belonged to a neighboring association, we would hope the Board would tell us so it could be rightfully removed. If the Board asked us to remove the tennis court because they didn’t want to fund for its replacement, that would go against National Reserve Study Standards (tennis court resurfacing meets the four-part test) and we would decline. If it is a major asset the association is responsible to maintain with a well-defined Useful Life and a predictable Remaining Useful Life, no matter who prepared or updated the Reserve Study, such a component should appear in the Reserve Component List. Anything else would be considered a misrepresentation of the facts.

Q: What should we do (a condo in FL) about a component that in its current state is too small for Reserve designation (a simple lock system on the front gate), but we want to replace it with a key-fob system that will cost much more?

A: That sounds like an appropriate technological upgrade. Not all assets need to be replaced because they physically fail. Review the tradeoffs to the association, and if the expense doesn’t cripple the Reserve Fund, go ahead. An alternative would be to levy a small special assessment to cover at least part of the upgrade. But either way, make sure the component is added to your Reserve Study for future consideration.

Q: What are true Reserve “surprises”?

A: A true surprise is just that, something that couldn’t have been reasonably anticipated. One client had been treating their pest control (termite) problems locally on an ongoing basis, and they find that has generally been expensive and ineffective, so they have decided to “tent” the association (a significant, once-ever-ten-years type expense). So that is a stylistic change, from minor operating expenses to Reserves… a new Reserve component, but should result in a net cost savings to the association. Another example is an elevator modernization project at a client, where the association found the developer had installed a prototype elevator system with special electrical needs, no longer available or appropriate. So in replacing their elevator control system, they had to run new electrical power lines all the way to their rooftop elevator control room. A significant increase over their budget for the modernization project! That is a one-time expense. More often, surprises have to do with components presumed to be an individual owner’s responsibility (balcony surfaces) or a component that had previously been expected to last “forever”. When it is the association’s responsibility, the association needs to take that responsibility (not bounce it back to the owners), and we need to deal with the reality that very few components last “forever”).

Q: Speaking of “forever”, how should we handle concrete items… long life, but somewhat indeterminate?

A: Small items, like patio slabs in an individual condo’s small back yard (exclusive use common area) can be generally expected to last an indeterminately long time. Sidewalks, driveways, etc. often suffer deterioration from trees or loads, so they crack and move. While an association may not know exactly where the expense will occur, it is often a good idea to set aside an “allowance” for the expense, an appropriately sized amount of money for repairs every few years.

Q: To what extent is the reserve specialist involved in determining current condition (Useful Life and Remaining Useful Life) of assets? Should the reserve specialist simply accept values given to him/her or should they satisfy themselves the values they have been given?

A: Any credentialed Reserve Study professional should deliver a work-product they could defend to the homeowners. In a Reserve Study update engagement, where the Reserve Component List already exists, the professional should review the Reserve Component List for completeness and accuracy, not simply “rubber stamp” what has been provided to them.