Every HOA faces the ongoing challenge of common area deterioration. Roofs wear out, pavement cracks, and landscaping requires ongoing maintenance. Ignoring these inevitable issues leads to costly special assessments, deferred maintenance headaches, and ultimately, declining property values. A HOA reserve study not only identifies these components and their life cycles but also lays out a financial strategy to create a reserve fund for inevitable repairs and replacements, ensuring the association’s fiscal and physical health is maintained.

A healthy reserve fund is critical for every HOA board. It allows the association to proactively save for repairs and replacements that are growing closer every day, avoiding financial strain, ensuring the long-term well-being of the community, and eliminating unnecessary “surprises”.

The Role of a HOA Reserve Study

A reserve study is a professional analysis that assesses an HOA’s current and future expenditure and funding needs. Through a comprehensive review of the association’s common areas and a detailed cost analysis, a HOA reserve study provides a clear picture of the funding required to maintain, repair, and replace all of its major components. There are three main types of reserve studies:

- Full Reserve Study with Site Inspection: This most in-depth study includes a thorough inspection of all common areas to identify and quantify potential issues and estimate repair or replacement costs. A full reserve study typically only occurs once.

- Reserve Study Update with Site Visit: This is typically conducted using the numbers from the full reserve study. Paired with some spot checking of quantities, it provides an update on funding needs based on changing costs and conditions. A with-site-visit reserve study update should occur at least every 3 years.

- Reserve Study Update with No Site Visit: This option utilizes existing data and prior studies to update the numbers on costs and funding requirements, but does not include a physical inspection. A no-site-visit reserve study update will usually occur in between the years you have your with-site-visit update.

Why Every HOA Needs a Reserve Study

Accurate HOA Financial Planning

A reserve study is crucial for accurate financial planning, allowing HOAs to anticipate and prepare for future expenses. This forecast of costs helps in avoiding expensive surprises (that aren’t really surprises, because they’re predictable!) that could lead to special assessments. That way you’re making informed decisions about predictable projects, maintaining homeowner satisfaction and financial stability.

Legal and Fiduciary Responsibility

Many states have specific statutes requiring HOAs to conduct reserve studies and fund reserves appropriately. Beyond legal compliance, it’s a fiduciary responsibility of HOA boards to protect the association’s assets. It’s your duty to make sure your community has adequate funds for repairs and replacements, protecting homeowner investments.

Increase Property Values

Properly funded reserves contribute significantly to the upkeep of the community, with a direct positive impact on property values. A well-maintained community is not only more appealing to current and prospective residents but also fosters a sense of pride and belonging among members.

What A HOA Reserve Study Provides

A reserve study typically unfolds three key results:

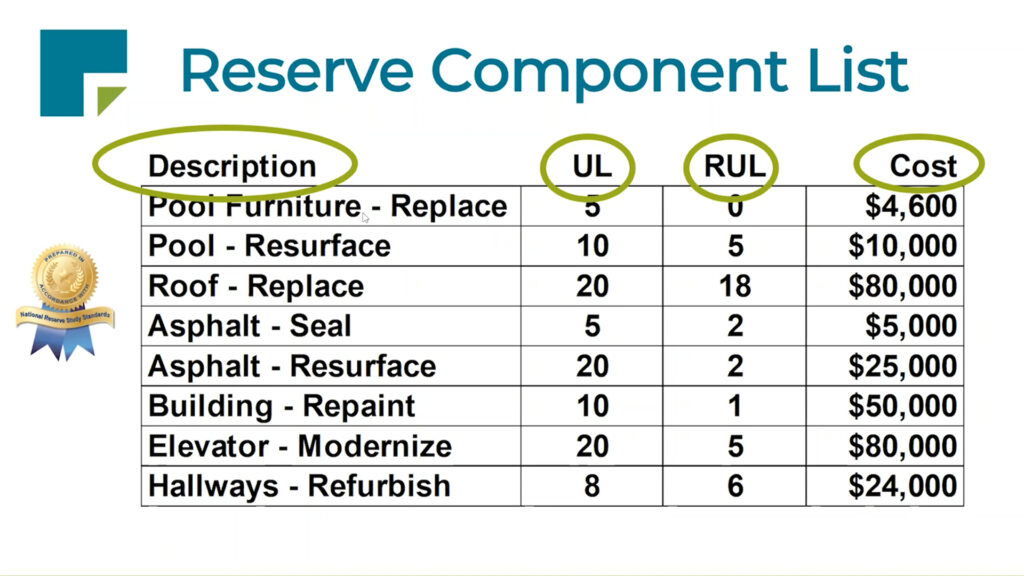

Component Analysis: This foundational step involves identifying and listing all the common area components the HOA is responsible for, assessing their current condition, life expectancy, and estimating their current cost to repair or replace.

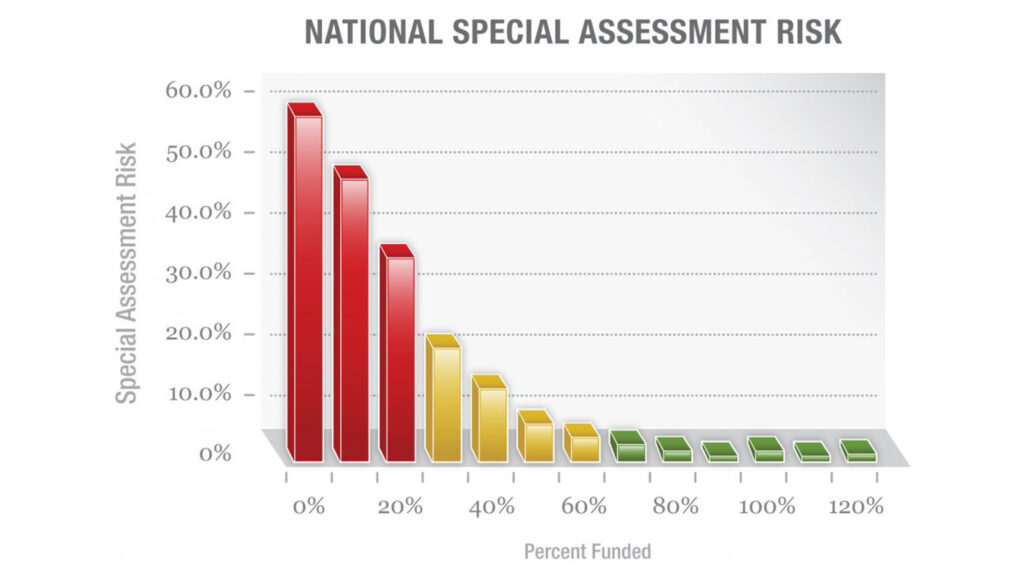

Financial Health Assessment: The study evaluates the association’s current reserve fund status, determining if the accumulated reserves are adequate compared to the projected needs (the amount of “deterioration” among Reserve components). This includes calculating the “percent funded” status, offering a clear picture of financial health.

The Funding Plan: Based on the analysis, the study proposes a detailed multi-yr funding plan. This plan outlines how much the HOA needs to allocate annually to the reserve fund to cover future expenditures without financial strain. The aim is to smooth out reserve funding requirements over time, preventing sudden financial demands on homeowners.

All our clients receive FREE access to our online budgeting tool, uPlanIt! With uPlanIt, you can test drive every budgeting scenario completely risk-free. This way, you know which numbers work and which ones don’t for your HOA. Learn more about uPlanIt here or click below talk to one of our reserve study specialists in your area!

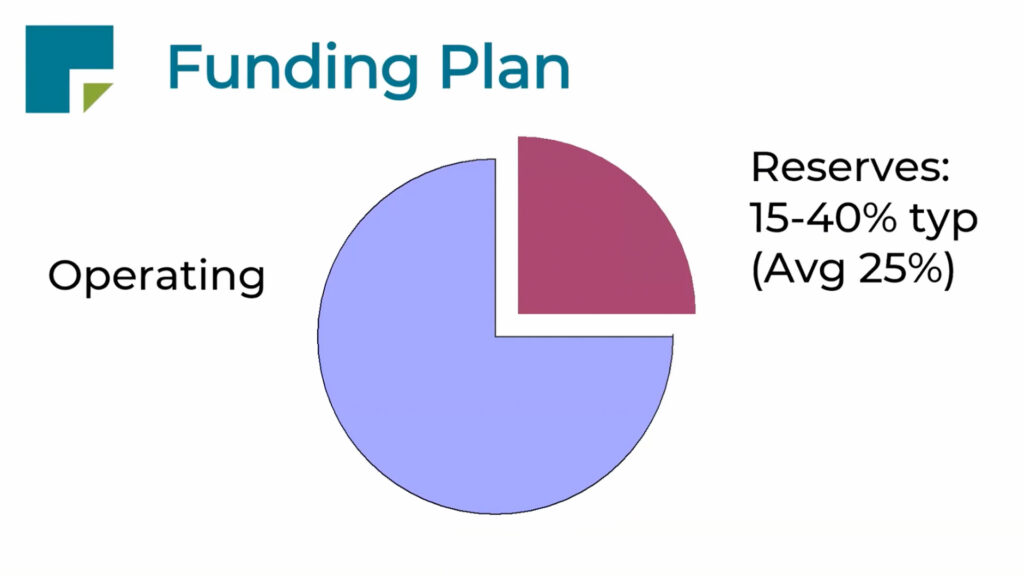

The Goal: Develop a Healthy HOA Funding Plan

HOA reserve funding typically requires between 15% to 40% of the annual budget, with a funding plan that considers both high and low expense years. The ideal reserve funding level for an HOA typically falls between 70% and 130% percent funded. This reduces your risk of facing special assessments and steep “catch-up” assessment increases for homeowners.

Regular Updates & Adjustments: Reserve studies are not set-and-forget documents. They should be reviewed and updated regularly (annually) to reflect changes in costs, inflation, component conditions, and reserve fund status.

Transparent Communication: Educating and involving homeowners in the reserve funding process is essential. Transparency about the necessity, benefits, and impacts of reserve funding builds trust and fosters community support. Remember – Reserve funding is not “charity” for future owners. Reserve funding offsets the cost of ongoing deterioration, so every owner pays their fair share over time.

Long-term Perspective: Effective reserve funding is a long-term strategy. Boards should resist the temptation to cut corners on reserve funding requirements, even when other financial pressures arise. The long-term health and viability of the community depend on it. The cost of ongoing deterioration never goes away.

By implementing a proactive approach to reserve funding through the use of reserve studies, HOA boards can ensure the financial health and longevity of their communities, honest communication with homeowners, and maximized property values. Remember that highlighting these long-term benefits fosters homeowner buy-in and strengthens the HOA. It’s about ensuring that the community not only survives but thrives, preserving the quality of life, safety, curb appeal, and property values for all residents.