The majority of Association-governed communities are underfunded. At the moment that the Board of Directors becomes aware that the Association is underfunded, they are faced with an important Reserve Funding decision. So it is essential to understand the consequences facing the Association due to the Reserve funding decisions made by the Board. We find the Reserve Funding choices of our clients fall into three categories:

• Succeeding – Following our advice to “Fully Fund” their Reserves

• Settling – Ignoring our advice, but choosing to “Baseline Fund” their Reserves

• Selling Out –Ignoring our advice and continuing to make inadequate Reserve Contributions

I’m going to give you an opportunity to stand on the sidelines and get a glimpse of the future as these three very different scenarios play out at a typical community association. See if you can recognize your own community in the Board decisions and their five year consequences

Most associations can expect to direct 15-40% of their budget towards Reserves to provide adequately for Reserve projects, and this association is only contributing about 6%. It comes as no surprise that our Reserve Study recommended a significant ($70/unit per month) increase over the current Reserve contribution rate of $19/unit per month, up to $89/unit per month. This is consistent with what we’ve recommended in prior years. At this new level, the Reserve contributions would fall more in line with expectations.

Now here’s what will happen, depending on which decision the Board makes:

If the Board chooses to Sell Out:

In this scenario, the Board ignores our “Full Funding” Plan recommendation and continues to set aside $19/unit per month for reserves. This decision could be based on a number of factors: Some Boardmembers may simply refuse to consider an increase in budgeted assessments. Some Boardmembers might be planning to sell their units within a year or two and conclude that the financial future of the Association is not their problem. Some Boardmembers may be concerned about affecting their own popularity among their neighbors. Other Boardmembers may feel a sense of resignation to the status quo and don’t have the time or energy to put up a fight.

The consequences of SELLING OUT – With Reserve contributions at only 6% of the total assessments, Homeowners and home-buyers will not be eligible for low interest mortgages, as FHA, Fannie Mae, and Freddie Mac require Reserves be funded at a minimum of 10% of total assessments. Higher interest rates mean homes are less affordable, dropping home values.

The Reserve Fund is projected to be completely depleted in five years. That means a special assessment will be necessary in year six for the roof project.

As the Board lingers over the special assessment decision, there is a delay in repairing and repainting the perimeter fence, which damages curb appeal, and puts additional downward pressure on home values. Yet another special assessment puts more downward pressure on home values, because a discerning Buyer will expect a discount when buying a home with a track record of special assessments. So in addition to not saving any net cash with the lower monthly dues (i.e., because homeowners paid it all back in special assessments), home values are down.

But what is the true cost of “selling out”? Assuming a starting home value of $381,000, based on current Zillow “zestimate” for units at this not-so-hypothetical Association, the homes will likely sell for at least 5% ($19,000) less in 5 years. So not only were the “savings” completely offset by the special assessment, homeowners lost money at the rate of $317/unit per month due to lower home values!

If the Board chooses to Settle:

In this scenario, the Board ignores our “Full Funding” Plan recommendation, but contacts us to ask for a “Baseline Funding” Plan. Baseline Funding refers to the amount of reserve contributions necessary to keep the Reserve Balance at barely “cash positive”. In other words, “We don’t need a lot of Reserves – tell us how much to contribute to just keep from running out of cash.” We run the numbers and provide an answer: $69/unit per month (a $50 increase over their current $19/unit per month rate). So the Board proposes to raise homeowner dues from $300/unit per month to $350/unit per month (a 14% increase), directing $69/unit per month to Reserves.

Increasing their Reserve contributions to this level would mean their Reserve contributions would comprise about 20% of total assessments. Note that this “Baseline Funding” Plan is not a whole lot different from the recommended $89/unit per month needed for “Full Funding” contributions.

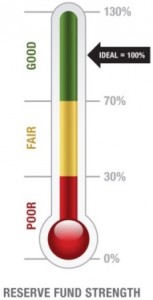

The consequences of SETTLING – Reserve Strength is expect to linger in the 40-60% Funded “Fair” range for another 10 years. Given the risk of Special Assessments at various Percent Funded ranges, the Association will have one or two Special Assessments during this time, offsetting most of the lower dues they had been enjoying. By year eleven, the Reserves dwindle and weaken further, plunging into the 0-30% “weak” range. At that point, the homeowners should expect a new special assessment every third year on average.

If the Board chooses to Succeed:

In this final scenario, the Board takes our “Full Funding” Plan advice and proposes to raise homeowner dues to $370/unit per month (a 23% increase) with $89/unit per month directed to Reserves. That is a big increase and a courageous move on the part of the Board and the homeowners to reverse the financial direction of their currently underfunded Association.

The consequences of SUCCEEDING – The association moves past its multi-year pattern of special assessments. By year five or six the Reserves will cross into the 70% Funded “Strong” range, stabilizing by year ten at close to 100% Funded. With sufficient cash, Reserve projects can be accomplished on time, and there is no deferred maintenance. Property values are maximized and Board meeting stress is minimized. Every owner can rest easy knowing they are paying their own fair share of deterioration on an ongoing basis. Hint – it would provide almost identically good results, and be a lot easier for homeowners to digest, if they had committed to two years of 11% increases instead of one year with a 23% increase.

So what are the lessons learned, besides the obvious fact that it takes a lot of money to maintain common area assets? There are financial rewards to Succeeding by deciding to follow the “Full Funding” recommendation from Association Reserves. Settling for a “Baseline Funding” Plan or Selling Out is a short-sighted and expensive decision. If your Association is underfunded to start with, special assessments and declining home values mean you don’t save any money by continuing to underfund Reserves. It’s hard to argue with the fact that Reserve Funding decisions have consequences and those consequences will either enhance or damage the financial health of the Association!