What is an HOA Reserve Fund?

Just like any building or asset, your community has components that will deteriorate over time. HOA reserves are the funds set aside to address these inevitable repairs and replacements, preventing special assessments and protecting property values. It’s the money you collect to pay for future repairs and replacements of your common areas like pools, roofs, gates, pavement, etc.

Think of HOA reserve funding as spreading the cost of repairs over time. Regular contributions are far more manageable than scrambling for a large sum when a major project hits. Deterioration is a fact of life, and ignoring it creates a financial burden for the future. It’s your responsibility as a board member to ensure a proper funding plan for these ongoing needs.

Why Fund Reserves?

There are two main reasons:

Avoids Special Assessments: Imagine a homeowner needing to pay a huge, unexpected bill for a roof repair all at once. Unfair, right? A sufficient reserve fund prevents this by spreading out the cost over time through regular contributions.

Maintains Property Values: A well-maintained community attracts potential buyers and keeps existing residents happy and proud of their neighborhood. Neglected buildings lead to lower property values, less return on investment for owners, and higher liability exposure.

Creating a Funding Plan

The Component List: Start with a list of reserve components your HOA is responsible for maintaining, like roofs, pools, and elevators.

Assess Your Starting Point: Evaluate the current health of your reserve fund. Is it strong, weak, or somewhere in between? If you’d like to learn more about calculating your current reserve fund strength, watch our Reserve Studies 102 webinar here.

Keep in mind these four key principles when creating a reserve funding plan:

- Sufficient Cash: Ensure enough reserve funds are available to handle upcoming projects on time.

- Budget Stability: Maintain predictable assessments for homeowners, this way there are NO surprises for them.

- Equitable Distribution: Spread the bill fairly across homeowners over time.

- Fiscal Responsibility: Allocate reserve funds wisely to ensure long-term financial health. Do not use them recklessly for other unnecessary items.

Assessments: While aiming to minimize assessments may seem appealing, it’s unrealistic. Inflation and rising costs mean future repairs or replacements will be more expensive than they are in our current economy. Planning for this in your HOA funding plan upfront avoids special assessments later.

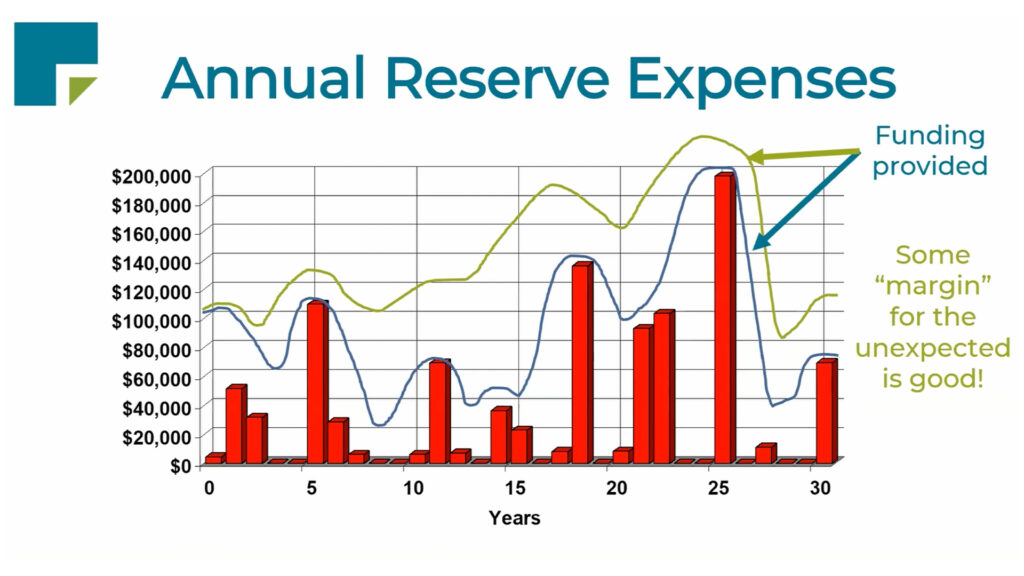

Reserve Funding Levels: The ideal level of funding depends on your community association’s specific situation. Factors include the components you maintain, your current reserve balance, and your desired margin for unexpected costs.

Margin for Error: Including a margin for unexpected expenses in your funding plan provides a safety net and prevents the need for special assessments if there are unforeseen circumstances.

Choose Your HOA Funding Plan Goal

Baseline Funding: Bare minimum to cover future expenses, but with a high risk of special assessments if anything unexpected happens.

Threshold Funding: Maintains a buffer above baseline to reduce the risk of special assessments.

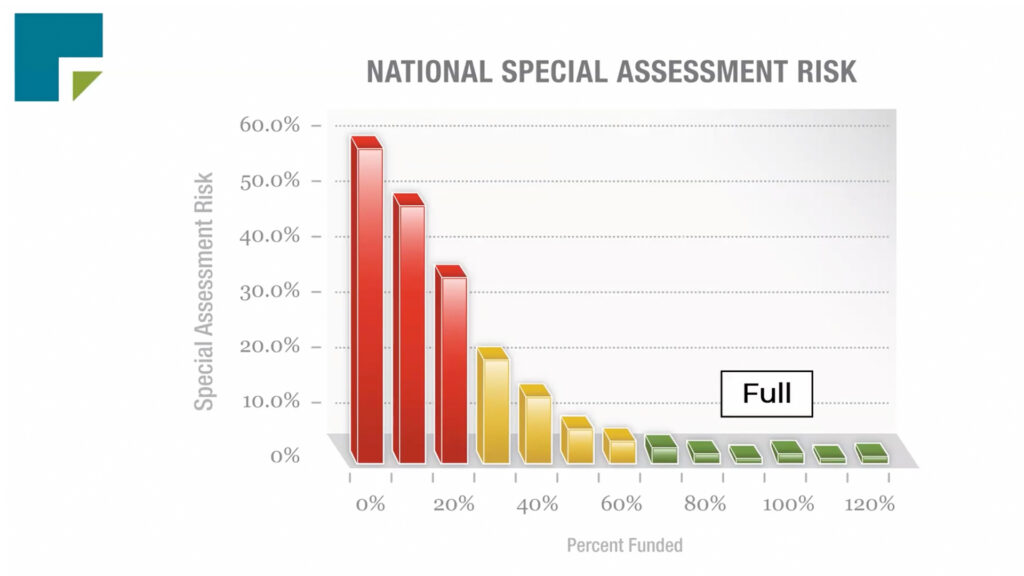

Full Funding: The ideal option, where the HOA reserve fund equals the estimated deterioration cost of your assets. Remember: 10-20% higher reserve transfers can lower your special assessment risk from 50% down to nearly 0%!

Select Your Reserve Funding Method

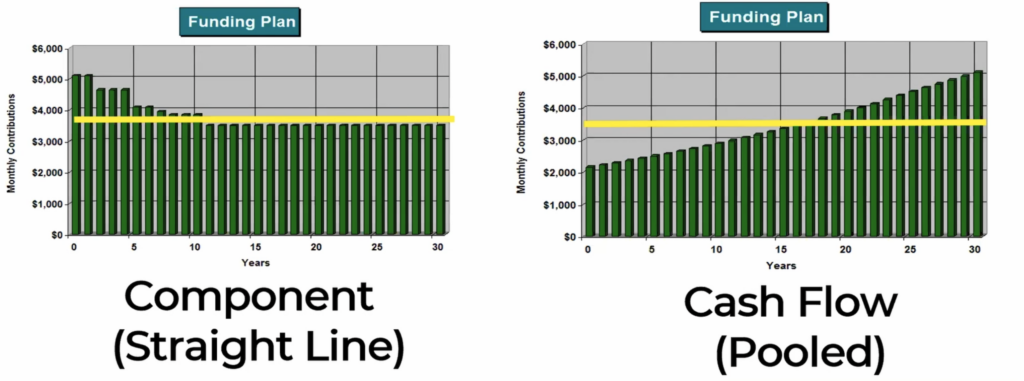

Component Method (Straight Line): Calculates reserve funding needs for each individual asset separately. This can be inefficient and leads to higher initial contributions.

Cash Flow Method (Pooled): Creates a smoother reserve funding plan by considering all future expenses together. The pooled method focuses on the annual cash need, rather than the need for each individual component. This way they all share one reserve fund rather than dividing them up for each component. It also avoids having to pay a steeper price in the first several years.

Bonus HOA Tips for Your Funding Plan

- Reserve funding is not an extra cost; it’s the true cost of owning a home in an HOA, spread out over time. When discussing reserve funding with homeowners, reframe it as paying for the “deterioration bill” rather than contributions.

- Aim to contribute 15-40% of your total budget towards reserves, with 25% being a good starting point.

Remember: As a board member, you’re responsible for maintaining the property and maximizing property values. A well-funded reserve plan using your reserve study is a key tool for achieving these goals.

Want to Learn More?

Contact a reserve study professional for a customized HOA funding plan specific to your community’s needs HERE.