Instinctively, we all know that large associations with many common area amenities in need of replacement should have a high Reserve Fund balance. Similarly, newly constructed small associations with only a few common area amenities have little need for much of a Reserve Fund balance. Every association has different Reserve requirements depending on the scope and timing of their Reserve projects. But is there any consistent way to measure the current “strength” of the Reserve Fund?

We all understand “absolute” monetary amounts. $2,000,000 seems like a “lot” of money, and we know that $100,000 is twice as much as $50,000. But it is another matter entirely to ask. “How much is enough?” The answer to this question is “relative” because it requires a comparison of the size of the Reserve Fund to the size of the Reserve requirements.

Percent Funded Explained

A ratio known as “Percent Funded” provides the answer to this question. Percent Funded is computed by comparing (as of a particular date) how the current Reserve Fund balance matches up against the association’s reserve needs (also known as the Fully Funded balance).

% Funded = Reserve Fund Balance (actual)/Fully Funded Balance (computed)

% Funded = 100 (ideal) when the Reserve Fund Balance is equal to the Fully Funded Balance

The association’s actual (or projected) Reserve Fund balance is simple to ascertain: one can simply tally the amounts indicated on bank or investment account statements. The Fully Funded Balance is the computed value of the deterioration of the association’s common area assets. This figure is determined by multiplying the fractional age of each component by its current estimated Replacement Cost, then summing them all together.

Let’s consider a simple example:

Imagine an association on the first day of the Fiscal Year, with a $40,000 Reserve Fund and two components: roofing and painting. With seven years “used up” of a 20-year Useful life and with a current replacement cost of $200,000, the roof’s Fully Funded balance is 7/20ths of $200,000, or $70,000. Assuming the paint is three years old out of a 5-year Useful Life and a current estimated cost of $50,000, the paint project’s Fully Funded balance is 3/5ths of $50,000, or $30,000. The association’s Fully Funded Balance is therefore $70,000 + $30,000 = $100,000.

Now let’s do the Percent Funded calculation:

% Funded = Reserve Fund Balance (actual) $40,000 / Fully Funded Balance (computed) $100,000

% Funded = 40%

Having $40,000 available to meet a $100,000 Fully Funded Balance means the Association is 40% Funded. You begin to see that the Association is “behind” in getting ready for their upcoming Reserve obligations.

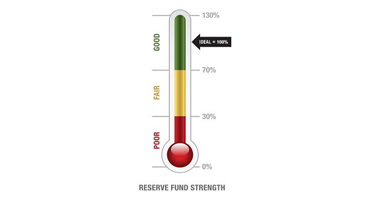

These simple computations help Boards gauge the relative “strength” of their Reserve Balance at a particular point in time. As a general rule, Associations under 30% Funded have a high risk of special assessments and deferred maintenance and their Reserve Fund is considered “weak”. At the “strong” end of the funding spectrum, special assessments and deferred maintenance are rare at Associations with Reserves that are at 70% funded or above, In-between represents a “fair” Reserve Fund status.

Percent Funded measures the strength of the Reserve Fund, typically at the beginning of each fiscal year. Percent Funded will change each year as the Reserve Balance and Fully Funded Balance fluctuate. The Percent Funded calculation is independent of Funding Plan objectives or calculation methods. Of course, the Funding Plan will influence if the Percent Funded increases, drops, or stays the same in future years.